The Department of Labor and Industries (L&I) takes L&I claim fraud very seriously. Under the Industrial Insurance Act, the letter of the law refers to fraud as “willful misrepresentation”. Under the law (WAC 296-14-4121) it says:

“[I]t is willful misrepresentation for a person to obtain payments or other benefits in an amount greater than that to which he or she would have otherwise been entitled. Willful misrepresentation includes making a willful false statement or the willful misrepresentation, omission, or concealment of any material fact.”

In fact, if L&I finds willful misrepresentation, they can demand repayment and assess a 50% penalty. If the willful misrepresentation is egregious, it can lead to criminal charges.

L&I claim fraud and scam

Recently, there was a story about a who pleaded guilty to a first-degree theft felony, in Renton, Washington. The man used his wife’s name and social security number to obtain work. He worked in multiple delivery jobs as a driver while collecting L&I time-loss and pension benefits. To receive pension benefits means he contended that he was incapable of working on a permanent basis. Moreover, in addition to the criminal sentence, he must repay $340K in benefits. Ultimately, this is one of the largest L&I scams in history. This story received a lot of media coverage.

Receiving time-loss or pension benefits under a workers’ compensation claim

A work injury claimant may not be able to work while recovering from an industrial injury or occupational disease. Therefore, to support injured workers during their recovery, they should get time-loss compensation. Here, to be paid, the time-loss compensation must be “certified”. Under a state-funded L&I claim, basic time-loss certification requires:

(1) Chart notes and forms from the attending provider, or the treating or consulting provider;

(2) An accompanying Activity Prescription Form (APF) from the examining provider; and

(3) A Work Status Form (WSF) completed by the workplace injury claimant.

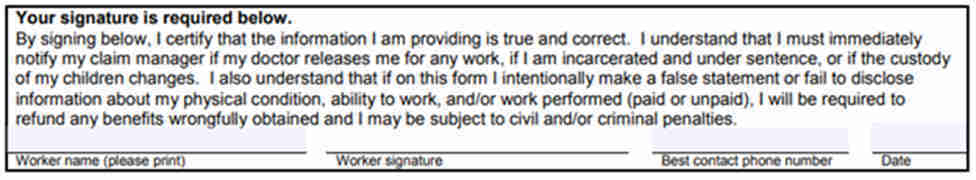

Generally, L&I makes every injured worker complete a WSF approximately every 30 days. If the work injury claimant fails to complete a WSF, then L&I might stop time-loss payments. The WSF is the best tool that L&I employs to prove willful misrepresentation. Explicitly, the WSF specifically asks the work injury claimant if they are working. It is not ambiguous. In fact, the bottom of the form must be signed by the injured worker, as shown in the image below. Signing serves as confirmation that the form contains truthful information.

L&I claim fraud while on pension

If you receive pension payments because of your workplace injury, you must complete and file a form once a year. The name of this annual form is Declaration of Entitlement. Remember, when completing this form, it must also be notarized. The form clearly asks whether the work injury claimant worked since submitting their last declaration. If the form is not complete within 30 days of its due date, L&I may suspend pension payment.

Final remarks

To summarize, dishonest people can hide work activity while collecting time-loss compensation or pension payments. Consequently, they are causing real and measurable damage to the workers’ compensation system. This behavior is unspeakable and is not tolerated. As L&I said in a recent announcement, this kind of willful misrepresentation is not a victimless crime.

Fraud in workers’ compensation claims and L&I claims hurts honest people trying to get better after a work injury. Recall, employees (and employers) pay L&I insurance premiums out of their pocket. They (and other stakeholders) are obvious victims. And, with that in mind, it’s important that victims of workplace accidents must be honest about their work status. That way, the system can continue to help those who really need help and assistance.

What happens when a self insured employer willfully misrepresents the injured workers job of injury? Not once,but several times, to get a claim closed, and sends the A.P. the false job detail,but only after they contact the doctor, claiming the claim is closed, and they will pay no more medical bills. Doctor cancelled all future appointments. The claim them closed. Do they get in some kind of trouble for that? Is there any recourse?

I know an Amazon employee that is about to get a lump sum for workers comp and they are working everyday for someone else while they are still getting paid by Amazon because they ( can’t work ), I have tried to report this but getting no where!

I have an employee who accepted a job with us and completed a WSF the very next day under a Labor and Industries claim against a previous employer and did not disclose that he had accepted a new job. He continued to to work while accepting claim payments from Labor and Industries until LaborandIndustriescaughtup to him. He was worked only 37 hours for us before filling another claim against my company. Are there any consequences for this behavior? He’s already filed 3 claims in only 6 years.

Hi Daniel. As you know, I represent injured workers and rarely get questions from employers. However, if you suspect your worker of fraudulent activity, you can report them to L&I here: https://secure.lni.wa.gov/reportworkerfraud/#/