The team members here at Reck Law, from our claim administrators, attorneys, to general staff, work very hard. The daily fight for the rights of work injury claimants in Washington State requires a lot of hard work and grinding. Therefore, we are humbled and appreciate this feedback, award, and recognition from our clients. Winning the Best Workers’ Compensation Law Firm in Puget Sound refuels and energizes us to continue to do our work. Thank you all very much for this award!

Category: Uncategorized (Page 1 of 68)

Work injury claimants must attend independent medical exams (IME) during their L&I claim. Historically, the Department of Labor and Industries (L&I) didn’t allow workers to record independent medical examinations.

The fight to allow video recording in IME exams

Many workers’ compensation attorneys opposed the status quo. After monumental efforts and in collaboration with the Washington State Association for Justice (WSAJ), the rules changed. Recently, the legislator enacted RCW 51.36.070. Now, starting July 23, 2023, injured workers may record their IME exam using video and/or audio recordings. However, to take advantage of this new rule, work injury claimants must follow proper procedures.

How to video-record an IME exam under my L&I claim

To comply with the new rule, to record your IME exam, you must take the following steps:

- Notify the IME provider – Workers or their legal representatives must notify the IME provider that they plan to record the exam. You must notify the provider at least seven (7) calendar days BEFORE the IME examination.

- Pay recording costs – It is your responsibility to pay all recording costs. Furthermore, these costs are not reimbursable.

- Hold recording equipment – The work injury claimant cannot hold the recording equipment during the examination.

- Do not interfere – The recording and the equipment cannot interfere with the examination.

- Provide a copy – If L&I or the self-insured employer asks for it, you must provide a cop of the recording within 14 days of the request.

- Can’t edit – – you must not edit or alter the content of the recording in any way!

- Don’t post on social media – Work injury claimants and/or their legal representatives may not post the recording or any portion of the recording on social media.

Can I bring an observer to an IME exam?

Absolutely! As before, you can bring someone with you to observe your physical IME exam. If you follow the procedures, the observer can take the recording for you. However, there are a few rules that apply to observers. These are not new rules. They include:

- Observers must be at least 18 years old;

- The observer cannot interfere with the independent medical exam;

- The work injury claimant’s representative (e.g., an attorney, or their employee) cannot be the observer; and

- Your attending provider or their employees also cannot be an observer.

An important step that benefits injured workers

As an attorney representing work injury claimants, I find RCW 51.36.070 very exciting. More than anything, the ability to record video and audio in IME exams will give workers greater peace of mind that the exam will be professional and thorough. In recent months I’ve heard all kinds of unbelievable complaints about IME tests. Common complaints include uncomfortable and inappropriate touching and closeness. Other issues are filthy and cluttered examination spaces. I even heard about IME exams where examiners give telephonic testimony while performing the exam.

I expect such issues to occur less frequently if workers can record IME exam. While I’m optimistic about this new rule, there are still several challenges we’ll need to work through as it takes effect.

Challenges with the new regulation to record IME exams

RCW 51.36.070 is still a very new law. We have not had much opportunity to see how recording video/audio during IME exams will play out. Furthermore, some of the language in the statute is not as clear as I’d like it to be. For example, the rule states that workers must give the IME provider notice at least 7 calendar days before the exam. Yet, the rule doesn’t specify how to give notice. As an attorney, it’s important for me to give notices in writing with some way to verify receipt. That way, if a disagreement ever arises over the notice, we can prove the worker gave the notice in time. Usually, the easiest way to do this is via fax because it produces a receipt. However, many IME providers refuse to provide a fax number. Another option is certified mail. However, this is time consuming and expensive.

Another logistical matter is the recording files. Legal representatives and work injury claimants are going to have to maintain these very large files. That is, without altering them in any way. Additionally, they will have to find ways to safely and confidentially transmit recording files to L&I and self-insured employers. Finally, it seems that various entities are fighting and questioning the new rule. The Courts will have to evaluate the statute itself to determine if it’s appropriate. For example, whether it is constitutional.

Summary – Can I record my IME exam?

Yes! Work injury claimants have the right to video/audio record IME exams so long as they follow proper procedures. Still, there are some kinks to work out as this new law takes effect. However, I hope that having the ability to video-record IME examinations will give work injury claimants confidence that they’ll receive fair exams.

veryone who works with me is used to hearing me say that “we absolutely must celebrate the successes”. The reason for this is simple. Representing work injury claimants isn’t easy. There are many days with absolutely nothing to celebrate.

Representing work injury claimants can be very challenging

We have clients who are in pain, stressed to the max, and hanging on by a thread. We have to respond to employers and retrospective rating groups spewing nonsense. Too often, we have to argue with claims managers and administrators who are biased and unfair. Every day we have to beg and plead with vocational counselors to do the right thing and give work injury claimants an opportunity to succeed through legitimate retraining programs. In short, we are constantly dealing with this kind of stress and adversity. It takes a huge toll on us. We have days when we wonder why we bother doing what we do. It is the successes that sustain us. In fact, it is not uncommon for us to rally around a success story just to pull ourselves out of negativity and renew our energy for what we do.

We absolutely celebrate our successes. In a big way. Today I’d like to share one of our favorite recent success stories. This story isn’t about us. It is about Josh Lopez. An amazing human that we count ourselves fortunate to know.

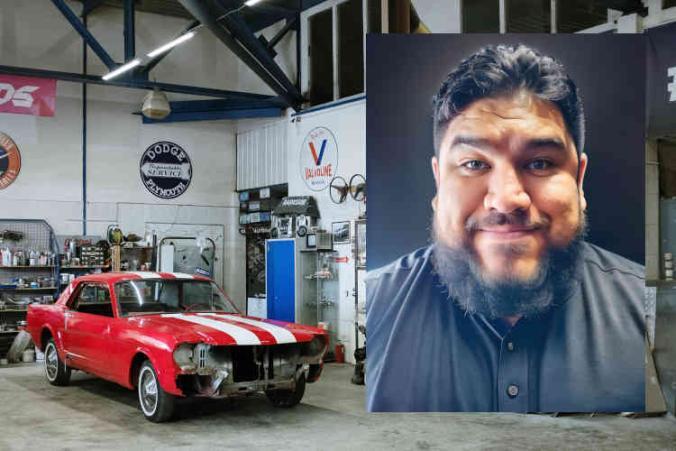

Meet Josh Lopez

Josh Lopez was born in Compton, CA but spent most of his childhood in Minnesota. Josh’s mother immigrated to the United States from El-Salvador and raised Josh and his siblings as a hard-working, single mother. Josh was always grateful for his mother’s hard work, but he struggled. He became a rebellious teenager and struggled through high school. In retrospect, he realizes this was largely because he had difficulty comprehending school subject matter. In his senior year of high school, Josh came to the self-realization that he wouldn’t succeed in college. Instead, he decided to enlist in the United States Army.

In the Army, Josh was trained to be a mechanic. He worked as a 91 Sierra Striker Systems Maintainer. Sadly, in a freak accident while on duty, Josh sustained a serious leg injury. That injury ended his military career. Josh recalls that being released to civilian life after sustaining a career-ending injury was incredibly difficult. Josh told me that it is a struggle for Veterans to transition out of the military. They are lost and their identity was wrapped up in their military service. It can be difficult to figure out how to maintain an identity when no longer serving. For Josh, the solution was to lean into his skill and experience as a mechanic.

Finding employment after military service

Josh left military service in August 2014. After that, he headed right to school. By September 2014 he was attending Universal Technical School learning how to perform specialized mechanics on high-performance cars. Very quickly, he realized he loved the work. For him it was deeply satisfying. It suited his personality and he felt truly happy working in that industry. According to Josh, his work as a mechanic outside the military allowed him to move on with his life. He gained valuable experience in the automotive industry. Furthermore, he developed enough confidence to start planning for opening his own shop.

It was at this very height of career, success, and happiness that Josh was dealt another crippling blow. On June 8, 2018, Josh Lopez sustained an industrial work injury while working in an auto shop here in Washington State. Josh explained to me that over the course of a year in an auto shop there are high volume times and low volume times. Low times usually occur in the winter months when people are more focused on the holidays and holiday spending. However, around the end of the school year, things begin to pick up significantly. People start trying to get all their automotive repair work done in advance of summer vacation.

A life-changing work injury and L&I claim

Josh recalls that in the last week of May and into June 2018, work in the shop really picked up. They were shorthanded. The mechanics were just “running and gunning” getting as many cars done as possible. The shop had just lost some lube techs and oil changers. Therefore, full-fledged mechanics like Josh needed to step up and handle those routine maintenance procedures as well. According to Josh, “it created chaos in the shop”. He was running around diagnosing cars and doing other mechanic work. Josh had to move rapidly from one thing to another, often managing multiple projects at once.

Doing what it takes

At one point, he recalls that a Nissan Titan came into the shop for transmission issues. He was trying to diagnose the Titian’s issues while doing his other jobs, to avoid further workload backup. They determined the Titan’s transmission needed repairs. As Josh began to pull the Titan out of the bay, the transmission blew right there. No matter what gear he put it in, the truck would not move. He knew he was going to have to move it by hand. He got out of the truck and called a car washer to help push the truck. Josh explained there is a slight decline at the exit and incline at the entrance of the bay.

Josh felt strong and thought they’d be okay pushing the truck out of the bay. However, as it approached that slight incline it got really heavy and hard to move. Josh tried to rocking it back and forth to get some momentum. As the momentum started to build, he leaned in and gave it his all. At that moment he felt an immediate snap and pop in his back. That pop sent him to the ground. He was in a lot of pain. But, like so many injured workers do, he tried to suck it up thinking the pain would go away on its own with time. Within a week, he was in such excruciating pain that he couldn’t get out of bed.

A career-ending work injury – what’s next?

Josh remembers that when he initially saw the doctor, he thought he’d be taking 1-2 weeks off work. That would give him enough time to recover and get back to doing what he loved. However, his pain didn’t resolve in 1-2 weeks. In fact, with an MRI the doctors learned that Josh had herniated multiple discs and flared up degenerative changes in his spine. It was then that the doctor gave Josh the worst news possible. The doctor told Josh he would never be a professional automotive technician again. Josh’s initial reaction was: “Thanks man, you just destroyed a 25-year old’s dream”. Josh admits that he knew it wasn’t the doctor’s fault. He recalls asking himself “what did you do to yourself?”

Josh told me that the injury and the loss of his “dream job” was bad. Yet, how he felt about it was so much worse because it completely upended all his life plans. You see, at that time he was on the verge of using a Veterans home loan to buy a house and an engagement ring for his girlfriend. With his industrial workplace injury, everything got put on hold. Josh said it was so hard to come to terms with it because this was his one identity. It was the one dream he had left, and it had been taken from him.

It was then that Josh tapped into his military roots and “did what soldiers do”. He had to “adapt and overcome”. Still, having had two career-ending injuries before his mid-twenties made him question what he had left in his life. He recalls that he got to a very dark place, wondering – what was the point and purpose of life? Was he just a field of broken dreams? What was left?

Frustration and self-doubt – Overcoming rock-bottom

Josh remembers that he was at a pretty low point in 2019 and 2020. That’s when his paralegal and assigned vocational counselor (VRC) told him that he might be able to retrain under his L&I claim. When his VRC brough up the idea of human services, his reaction was “why would I do that”? However, he soon learned that human services is a very broad field. It offers a variety of employment opportunities. Josh describes it as “being of service to your fellow human beings in the hopes of them being better”. The more he researched and talked to teachers and advisers at Tacoma Community College (TCC), he realized human services could be a pathway for him to work with Veterans. In fact, his teachers, advisers, and VRC were able to give Josh a roadmap for how to accomplish that goal.

It is well known that there is a high suicide rate in the military. In fact, Josh told me that half of his Army team has been lost to suicide. Thinking about this tragedy, Josh said: “it was hard” but “it set a fire in my soul” and “I knew this is what I needed to go and do”. He was determined to try his best and save as many lives as he can in the memory of his lost team members.

Achieving L&I claim success through vocational retraining

I asked Josh how he felt about retraining through his L&I claim. At first, I recall he said that he was really scared. In his words: “I was going to school, after X amount of years, wasn’t great at school before unless it was hands on training or work, and going back to books freaked me out”. However, despite being scared, he was also motivated. He said, “when I found out about 2 years of FREE school, I’d be stupid not to take advantage of that!”. “If they ended my claim, what would I do? Where would I go? Mc Donald’s? No way!”.

Finding motivation from within

So, that was the motivational kick he needed to do the best he could. “I didn’t think I’d go in there and rock straight A’s. I thought I was going to barely pass. But I did succeed.” In fact, Josh didn’t just succeed. He killed it. In the Spring of 2023, Josh Lopez completed his human services program at TCC with a perfect 4.0 GPA.

When we talked about the completion of his program and graduation, Josh told me “at this point, there is no stopping me, there really isn’t. At TCC after the first two quarters I didn’t realize I had straight A’s and all of a sudden it was like ‘snap, I can do it’. I am so proud of myself to say I graduated with a 4.0, straight A’s and high honors. To see such pride in my mom’s eyes that I did it, was the most amazing thing because I am now a partial fulfillment of her dreams, and she is so proud of that. Seeing one of her kids go to college and graduate with those kinds of grades as first generation Latino American, it left her with a pride that was an amazing feeling and amazing to see.”

Finding new employment after a work injury

Upon graduation, Josh got a job at Nine Line. It’s a Veteran services organization that he interned for as part of his TCC human services program. Josh recalls that in the winter 2021, he was at Bethel Middle School watching his son’s concert. That’s when a guy walked in with a fleece labeled “Nine Line Veterans Services”. He immediately recognized the reference to Nine Line as a medical evacuation of an injured soldier. “The first Nine Lines is imperative to saving the life of the solider”, he told me. Josh introduced himself to the man and asked to stay in contact.

The next quarter, Josh had a school assignment to interview someplace where he wanted to intern or work. Josh interviewed with Nine Line. Later, they invited him to intern there. Through his internship, Josh benefitted from the mentorship he received at Nine Line. He ended up satisfying all three of his program internship requirements there.

Josh recalls that at the end of his internships his primary mentor asked: “Why should I hire you?”. Josh said: “I spent three internships with you, learning about everything you do, how you do it and why you do it. I’m a reflection of you. You made me into who I am. You’d be dumb not to hire me”. Josh confesses it was a bold answer. Josh knows he still has a lot to learn in a growing and changing field. But, through his retraining under his L&I claim, he understands human services in the Veterans social space (in King, Pierce and Thurston counties).

Inspiring and helping others

When I asked Josh what advice he would give other work injury claimants about retraining, he said: “Find an internship. Get in there and fight”. In 2023 Josh joined Vet Corps which is an AmeriCorps program that also helps with tuition money for school. On June 24, 2023, Josh held an event based on Dungeons and Dragons (D&D) to create a Veteran’s resource fair. This is Josh’s brainchild. He explained that he is trying to bring gaming and resources together to bridge the gap of uncertainty between Veterans and services. According to Josh: “a lot of Vets are coming out and don’t know what is available for them. Many of them are nerds. I am trying to break down the requirement thresholds and make sure there is help for everyone”. His D&D style resource fair is one way to help Veterans access services in a fun and non-intimidating way.

Josh has plans to use post 911 GI Bills to continue his education at the University of Washington (UW) to obtain a Bachelor’s Degree. Eventually, he’d like to attend the University of Minnesota because he always admired that school, but never saw himself going there until now. He told me: “I want to get there, and I need to get there. I have had so many dreams taken away from me, but this is one of the dreams I need to achieve in my life. I just have to”. There’s no doubt in my mind that Josh is going to achieve his dreams. I know he is going to help a lot of Veterans along the way.

A work injury and L&I claim affect the entire family

After his graduation, while at a family celebration, Josh finally got down on one knee and asked his long-time girlfriend to become his wife. It was a dream he put on hold in 2018 when he suffered his first injury. As I told Josh, when we spoke about his story, it has been the greatest pleasure for all of us at Reck Law, to be part of Josh’s journey. It’s an honor that he chose us to be his representatives. More importantly, we enjoyed being able to support and cheer him on. There were more than a few tears shed when Josh sent us photos of his graduation and engagement celebration.

L&I claim success is easy with the right people

I would be remiss if I did not specifically name and thank two other individuals who had an invaluable impact on Josh’s successful retraining. So, special thanks to Terrance O’Toole, a dedicated Reck Law paralegal who assisted Josh with his claim since June 2020. We are also incredibly grateful to Sean Murphy from Peninsula Vocational Services, who put in a tremendous amount of time and effort ensuring Josh had access to the best retraining program possible.

It is easy to find workers capable of working in random transferable skills jobs. It’s also easy to draft simple and short online training plans. However, it takes time, effort, and commitment to assist work injury claimants in accessing legitimate retraining programs like the program Josh completed. Without Sean’s willingness to invest in Josh, this success story would look very different. Thank you, Sean Murphy, for believing in Josh and putting in the work needed to make this a success.

Congratulations Josh Lopez! You are a one-of-a-kind human and a true inspiration!

If you would like to support Veterans services, please consider donating to Nine Line: https://nine9line.org/donations

This article was published in collaboration with and with permission from Josh Lopez.